Card Strategy

Complete card program design

Data Analytics

Real-time program insights

Customer Acquisition

Targeted acquisition strategies

End-to-End Card Program Technology

Our comprehensive platform handles every aspect of your co-branded card program lifecycle

Card Strategy & Design

Strategic card program design aligned with your business goals

Card Strategy & Design

Banking Partnerships

Rewards Engine

Customer Acquisition

Analytics & Insights

Comprehensive Co-Branded Card Features

Our platform provides everything you need to launch and manage a successful co-branded card program

Card Strategy & Design

Develop comprehensive co-branded card strategies aligned with your business goals and brand identity.

Banking Partner Selection

Identify and secure partnerships with the right banking institutions for your co-branded card program.

Financial Consulting

Expert financial guidance to maximize revenue streams and optimize program economics.

Rewards Program Creation

Design compelling rewards programs that drive card usage and customer loyalty.

Customer Acquisition

Implement targeted acquisition strategies to grow your cardholder base efficiently.

Spend Increase Tactics

Deploy proven tactics to increase card spend and transaction frequency.

Points Management

End-to-end management of credit card points systems with seamless redemption options.

Partnership Management

Ongoing management of relationships with card networks, banks, and other stakeholders.

Compliance & Security

Ensure all card programs meet regulatory requirements and maintain the highest security standards.

Industry-Specific Card Programs

Tailored co-branded card solutions designed for the unique needs of different industries

Industry Solutions

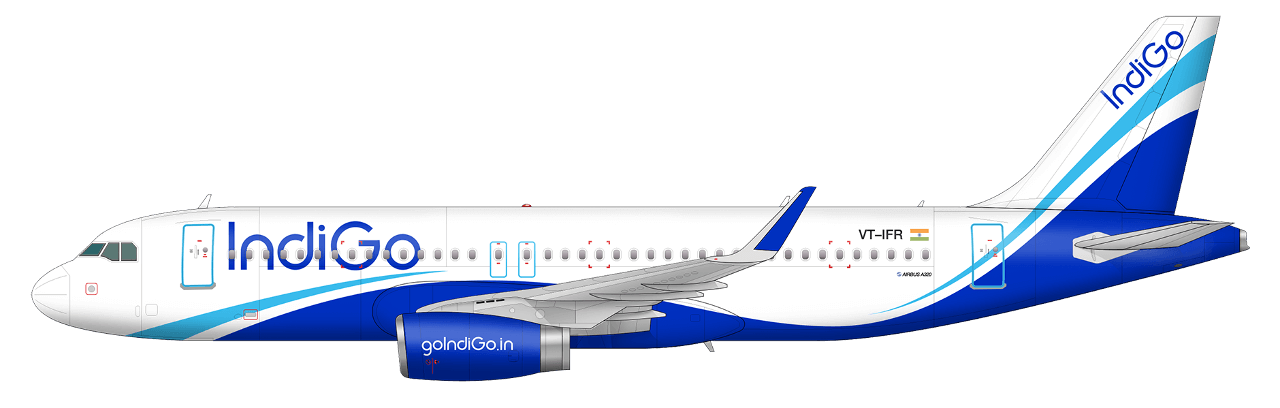

Airline Co-Branded Cards

Drive customer loyalty and ancillary revenue with airline co-branded cards that offer miles, priority boarding, and other travel perks.

Average Increase in Bookings

Increase in Ancillary Revenue

Customer Retention Improvement

Implementation Process

Strategic analysis of customer travel patterns

Custom tier design with specialized benefits

Integration with existing loyalty program

Multi-channel acquisition campaign

Ongoing program optimization

Sample Customer Dashboard

Successful Implementations

Live Program Performance Metrics

Real-time insights into your co-branded card program performance

Active Cardholders

Total active cardholders across all programs

Monthly Spend Volume

Total monthly transaction volume

Customer Retention

Annual card renewal rate

Engagement Score

Cardholder engagement benchmark score

Customer Acquisition

Monthly Spend Volume

Rewards Redemption Analysis

87% of customers redeem their rewards within 12 months

Cardholder Engagement Metrics

Interactive Card Experience

See how our co-branded card platform delivers a seamless customer experience

Real-Time Transaction Experience

Our co-branded card platform provides a seamless, real-time experience for cardholders across both mobile and web platforms. Every transaction triggers an instant reward calculation and notification system.

Instant Reward Processing

Points are calculated and credited in real-time with each transaction, providing immediate gratification to cardholders.

Multi-Platform Support

Consistent experience across mobile apps, web portals, and physical cards, with synchronized data across all channels.

Enhanced Security

Advanced fraud detection and prevention systems that protect both cardholders and your brand reputation.

Integration Capabilities

Our platform seamlessly integrates with your existing systems through secure APIs, requiring minimal IT resources for implementation.

Interactive Card Designer

Visualize your co-branded card with our interactive design tool

Card Customization

Did you know?

Our design team can create custom card designs that perfectly match your brand identity, including special materials, finishes, and security features.

Industry Comparison

See how our co-branded card solution compares to alternatives in the market

Feature Comparison

Compare CustomerInspire's solution with Competitor A

CustomerInspire

features supported

Competitor A

features supported

CustomerInspire Advantage

more features than competition

| Feature | CustomerInspire | Competitor A |

|---|---|---|

| Program Design | ||

| Strategic Card Design | ||

| Multi-Tier Program Support | ||

| Custom Reward Structure | ||

| Personalized Card Experience | ||

| Banking Integration | ||

| Multi-Bank Support | ||

| Seamless Onboarding API | ||

| Real-time Transaction Processing | ||

| Automated Compliance Checks | ||

| Customer Experience | ||

| Mobile App Integration | ||

| Digital Wallet Support | ||

| Personalized Offers | ||

| Omnichannel Experience | ||

| Analytics & Reporting | ||

| Real-time Performance Dashboard | ||

| Customer Segmentation Analysis | ||

| Predictive Spending Models | ||

| Custom Report Generation | ||

| Program Management | ||

| End-to-end Program Management | ||

| Automated Reward Distribution | ||

| Fraud Prevention System | ||

| Dedicated Support Team | ||

Enterprise Integrations

Connect our co-branded card platform with your existing enterprise systems

Integration Categories

Banking Core Systems

Seamless integration with core banking platforms for account management and transaction processing

Integrated Partners

Integration Benefits

Simplified Integration

Pre-built connectors and APIs reduce implementation time by up to 60%

Real-time Synchronization

Bi-directional data flow ensures all systems stay updated with the latest information

Secure Data Exchange

Enterprise-grade encryption and security protocols protect sensitive information

API Reference

/api/v1/cards/issue/api/v1/transactions/api/v1/rewards/{customer_id}/api/v1/cards/{card_id}Implementation Timeline

Ready to Launch Your Co-Branded Card Program?

Partner with CustomerInspire for a turnkey solution that handles every aspect of your co-branded card program, from concept to execution and beyond.

End-to-end program management

Expert banking partnership selection

Custom rewards program design

Targeted customer acquisition

Ongoing optimization and support

Why Choose CustomerInspire?

Proven Track Record

With over 1 million cards in circulation and 25+ successful programs launched, we have the expertise to make your program a success.

Turnkey Solution

From strategy to execution, we handle every aspect of your co-branded card program, allowing you to focus on your core business.

Data-Driven Approach

Our analytics capabilities provide actionable insights to continuously optimize your program for maximum ROI.