Banking Industry

HSBC's Digital Banking Loyalty Transformation

How HSBC leveraged CustomerInspire to drive digital adoption and increase customer lifetime value

67%

Increase in digital adoption

41%

Growth in product cross-sell

3.8x

ROI on loyalty program

The Challenge

HSBC, one of the world's largest banking and financial services organizations, faced several key challenges:

- Low adoption rates of digital banking services among traditional customers

- High customer acquisition costs in competitive markets

- Limited cross-selling success across their diverse product portfolio

- Growing threat from fintech disruptors with superior digital experiences

- Regulatory constraints creating limitations for loyalty program design

The Solution

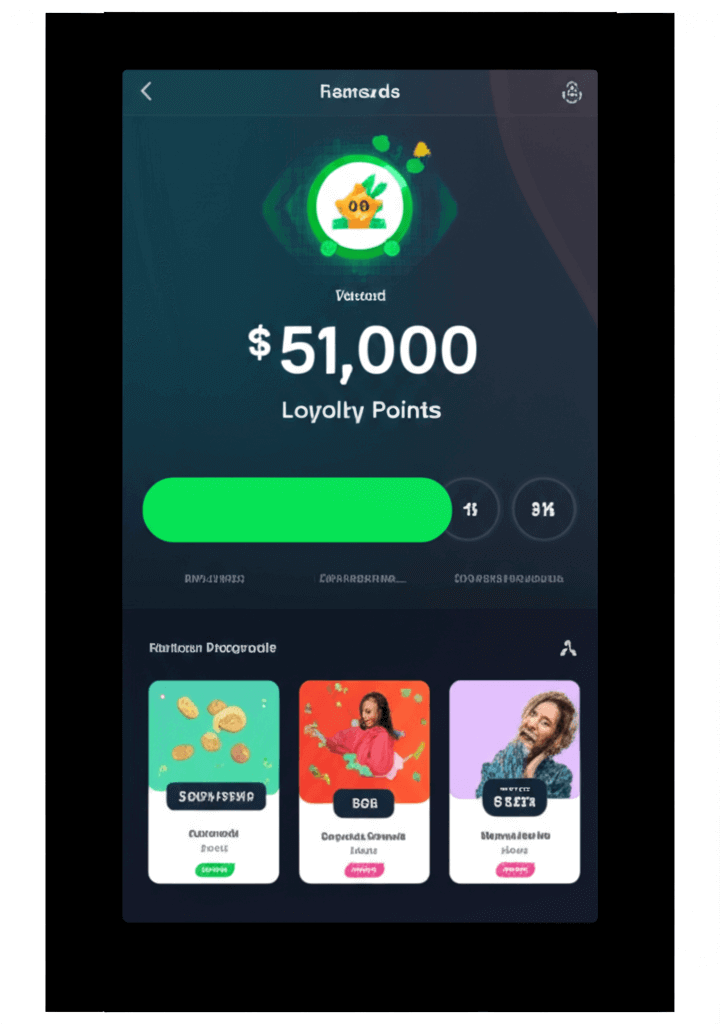

CustomerInspire worked with HSBC to implement a comprehensive loyalty strategy focused on:

- Behavioral Rewards: Rewarding customers for digital adoption and positive financial behaviors

- Lifestyle Benefits Ecosystem: Creating a rewards marketplace connecting banking activity to real-world lifestyle benefits

- Financial Health Gamification: Gamifying financial wellness activities to drive engagement

- Predictive Next-Best-Offer: Implementing AI to recommend relevant financial products at optimal moments

- Partner Network: Building a global network of premium partners for unique redemption options

Implementation Process

The implementation was completed in five phases over a 10-month period:

- Compliance Framework (2 months): Established a regulatory-compliant structure for the loyalty program

- Data Integration (2 months): Connected customer data across retail banking, wealth management, and credit cards

- Behavioral Analysis (2 months): Developed customer segmentation and behavioral reward triggers

- Partner Integration (2 months): Onboarded and integrated global lifestyle partners

- Phased Launch (2 months): Rolled out to premium customers first, followed by broader customer base

Results

Within 18 months of implementation, HSBC achieved:

- 67% increase in digital banking adoption among targeted segments

- 41% growth in product cross-sell conversions

- 33% reduction in digital customer acquisition costs

- 29% improvement in customer lifetime value

- 24% increase in customer deposits

- 3.8x return on investment in the loyalty platform

Key Learnings

The HSBC implementation revealed several important insights about financial services loyalty:

- Behavioral rewards are more effective than transactional rewards in banking

- Regulatory constraints can be navigated with proper compliance frameworks

- Lifestyle benefits create emotional connections that financial rewards alone cannot achieve

- Digital adoption correlates strongly with increased product holdings

- Personalization drives significantly higher engagement in financial services